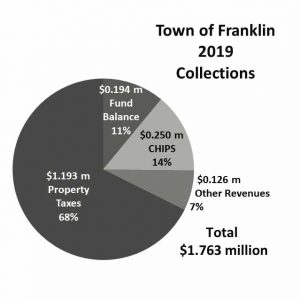

The tentative 2019 budget for the Town of Franklin spends $1.76 million. To partially finance this, the town board plans to raise $1.19 million in property taxes from landowners, an increase of $ 0.03 million (2.4%) over the 2018 budget. This levy is just under the state-imposed soft cap and similar to the increase in 2018.

Increases in appropriations total $45,755, of which increases in salaries (personal services, PS) contribute only $2,100: superintendent of highways $500 (1% increase), assessor $350 (1%), director of finance $750 (6%), and justice $500 (9%). Only the superintendent received an increase in the previous year.

With these increases, salaries for the town officials would be: superintendent of highways Laing, $47,700; assessor Basile, $27,850; supervisor Taggart, $15,900; clerk/collector Ritz, $15,500; CEO Jacobs, $15,000; finance director Warner, $12,750; justice Arndt, $6,000; dog control officer Lockwood, $1,800; and councilmen Bruno, Grant, Sitts, and Smith, $1,200 each. (Taggart’s salary divides as $3,800 (24%) from the town and $12,100 (76%) from the county.) The total of salaries for town officials in budget is $135,200. In addition is $61,000 in benefits for a grand total of $196,200.

At the October meeting of the town board, Mr. Arndt requested an increase to $7,500 citing the responsibilities and work load of being the sole justice in the town. Previous raises were $500 in 2013 and $750 in 2009. For comparison, the smaller town of Kortright pays its justice $12,000.

Capital expenses (contractual expenditures, CE) increase a total $45,050: assessor equipment $1,700, engineering $2,500, board of assessment review $50, building $7,100, garage $4,100, contingency $1,700, cemeteries $6,900, machinery $9,000, and repairs $12,000.

Only two appropriations are cut. For the attorney Sacco (Coughlin & Gerhart, LLP), appropriation is cut from $5,000 to $2,500 (50%). Appropriation for the Franklin Free Library is cut from $2,000 to $1,500 (25%). These cuts save 0.085% and 0.028% of budget.

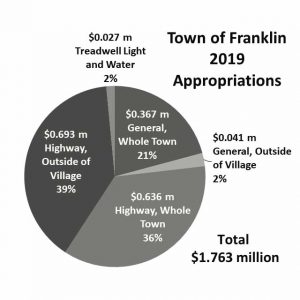

Appropriations and revenue for the hamlet of Treadwell are unchanged from 2018. Expenditures of $26,750 are partially offset by revenues of $11,030. The balance of $15,720 is a subsidy paid by all Franklin landowners.

With only these small changes, the 2019 budget would be similar to that of 2018, with highway department receiving $1.326 million (75.4%), all other town accounts (general) $0.408 million (23.1%), and Treadwell light and water $0.027 million (1.5%). Of the highway appropriations, labor (wages and benefits) accounts for $0.555 million or 31.5% of budget.

These appropriations are mostly paid by property taxes, but there are significant contributions from revenues and appropriated fund balances. Revenues increased roughly $52,445, mostly from rent of space on the cell tower for additional antennas and from increased Consolidated (Local Street and) Highway Improvement Program (CHIPS) funds.

Appropriated balances are funds carried over from the previous years. These funds are allocated to provide operating cash and a buffer for unexpected costs. The total of $194,000 is down $35,000 from last year and is all in highway accounts. This year the term for this category is changed to appropriated fund balance from unexpended balance. That term was misleading because this category does not include all unspent funds.

Recently filed Annual Update Documents (2014 to 2017) show funds that are not reported in the budget document. Total fund balances in the AUDs typically show over a hundred thousand dollars more in cash than in the budget. For example, last year the total unexpended fund balances reported in the budget was $229,000, whereas the total reported in the AUD was $552,050 — more than double the amount. Funds in town savings accounts are not listed in the budget document. This year, Supervisor Taggart has revealed that the account for construction of new offices has grown to over a hundred thousand dollars.

This year was the first since 2008 that this data was reported. AUDs had not been filed for eight years until this spring, after a second audit by the NY Office of the State Comptroller again cited this delinquency. Balance sheets for Franklin 2004 to 2008 and 2014 to 2017 can be read, downloaded, or printed at:

http://wwe2.osc.state.ny.us/transparency/LocalGov/LocalGovIntro.cfm

The increase in the levy for the Franklin and Treadwell Fire Departments, which is set by the departments themselves, was not known at the time of the budget workshop. Levy for 2018 was $0.216 million. This levy is collected through the town tax billing but is not part of the town budget.

This tentative budget was considered during the annual budget workshop at the board meeting on October 2nd. Beforehand, the tentative budget was prepared by supervisor Taggart (financial officer) in consultation with director of finances Warner (assistant financial officer). At the workshop, Mr. Warner read only the changes from the 2018 budget. (If you forgot to bring your copy of last year’s budget, then you could not follow his presentation.) After some remarks by the supervisor and councilman Smith, the board approved his tentative budget without change. Thereby, it became our preliminary budget.

Copies are available from the town clerk. A public hearing on the preliminary 2019 budget will be held Wednesday the 7th of November at 7:30 p.m. in the Town Hall. Mistakenly, the place and time of this public hearing was not set during the regular October meeting but at a special meeting on October 16th.

Immediately after this hearing, the board may approve the preliminary budget either with or without revisions. While a budget does not have to be passed that evening, it must be approved by November 20th.